Market Talk

The recent economic reports show that the US economy had a slower than expected growth GDP rate and inflation rose more than the Federal reserve is targeting. This points to a possible economy coming that fits the definition of stagflation. Typically during stagflation as in the 1970's, jobs suffer and good cost more, investors get squeezed and in general stocks can decline.

There is one area that rose during the 1970's - Gold. It went from $100 an ounce in 1976 and has risen since to over $2000. Gold, now trending over $2300 with many pundits pointing at the $3000 mark as countries and central banks are buying and storing GOLD as a hedge against fiat currency inflation.

Stock Talk

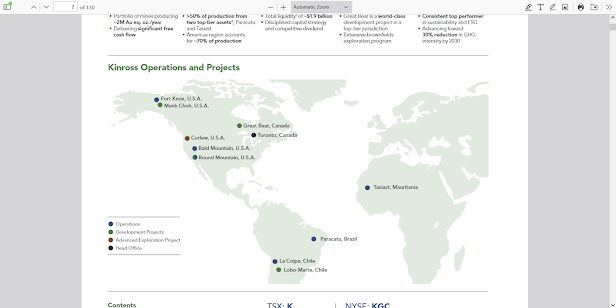

Perhaps holding a Gold miner like Kinross Gold (KGC) in the 6's is a way to stay long in the gold sector. With rising gold prices , earnings could surprise and surge a stock like KGC higher from a single digit stock to a double digit stock and it pays a 1.7% dividend as well.

https://www.kinross.com/operations/default.aspx

UPDATE: Another one to watch is Taseko Mines (TGB) trading in the $2's at the current share price. As a note, that TGB has both Gold and Copper reserves. It seems Copper is also in growing demand.

https://finance.yahoo.com/news/taseko-reports-first-quarter-2024-000000340.html

For now, we close by noting that any view on the market and stocks on any particular day may change in the future days to come. That is why we watch and see how our views match up with the reality of the time. But trying to look ahead a few months into the future may be a way to do things. If you think too deep about world events and the recent alliances forming, projecting ahead can be a dicey endeavor. In all - we use the word maybe "some", not "too much" and play it accordingly. Remember never get arrogant in our various notions because things do change in the market and individual stocks are subject to many factors outside of our control.. So we try to -stay aware.

With all the above caveats and attempted prognostications, I will close this post. Stay tuned for more opining on the market and stocks to watch.

_____________